Ever looked at a u s dollar chart and felt like you were staring at a polygraph test for the global economy? You aren’t alone. It’s chaotic. It’s messy. Most people see a line moving up or down and think they understand "strength," but the reality is way more nuanced than just a simple price tag.

The dollar doesn't live in a vacuum. It’s a relative beast. When you see the DXY—the U.S. Dollar Index—climbing, it doesn't always mean the American economy is firing on all cylinders. Sometimes, it just means everyone else is doing worse. It’s the "cleanest shirt in the dirty laundry" effect.

Charts tell stories. If you know how to read them, you’ll see the scars of inflation data, the fingerprints of Federal Reserve Chair Jerome Powell, and the nervous whispers of bond traders.

The DXY and Why Your Favorite U S Dollar Chart Might Be Lying

If you’re looking at a chart of the dollar against the Mexican Peso or the Japanese Yen, you’re only getting a tiny slice of the pie. Professionals usually look at the U.S. Dollar Index (DXY). This is a weighted average of the dollar against six major world currencies.

The Euro makes up a massive 57.6% of that index. Think about that for a second. If the Eurozone has a bad day because of energy prices or political turmoil in France, the u s dollar chart for the DXY will spike. It looks like the dollar got stronger. In reality, the Euro just got weaker.

🔗 Read more: Walt Disney Company Current Stock Price: What Most People Get Wrong

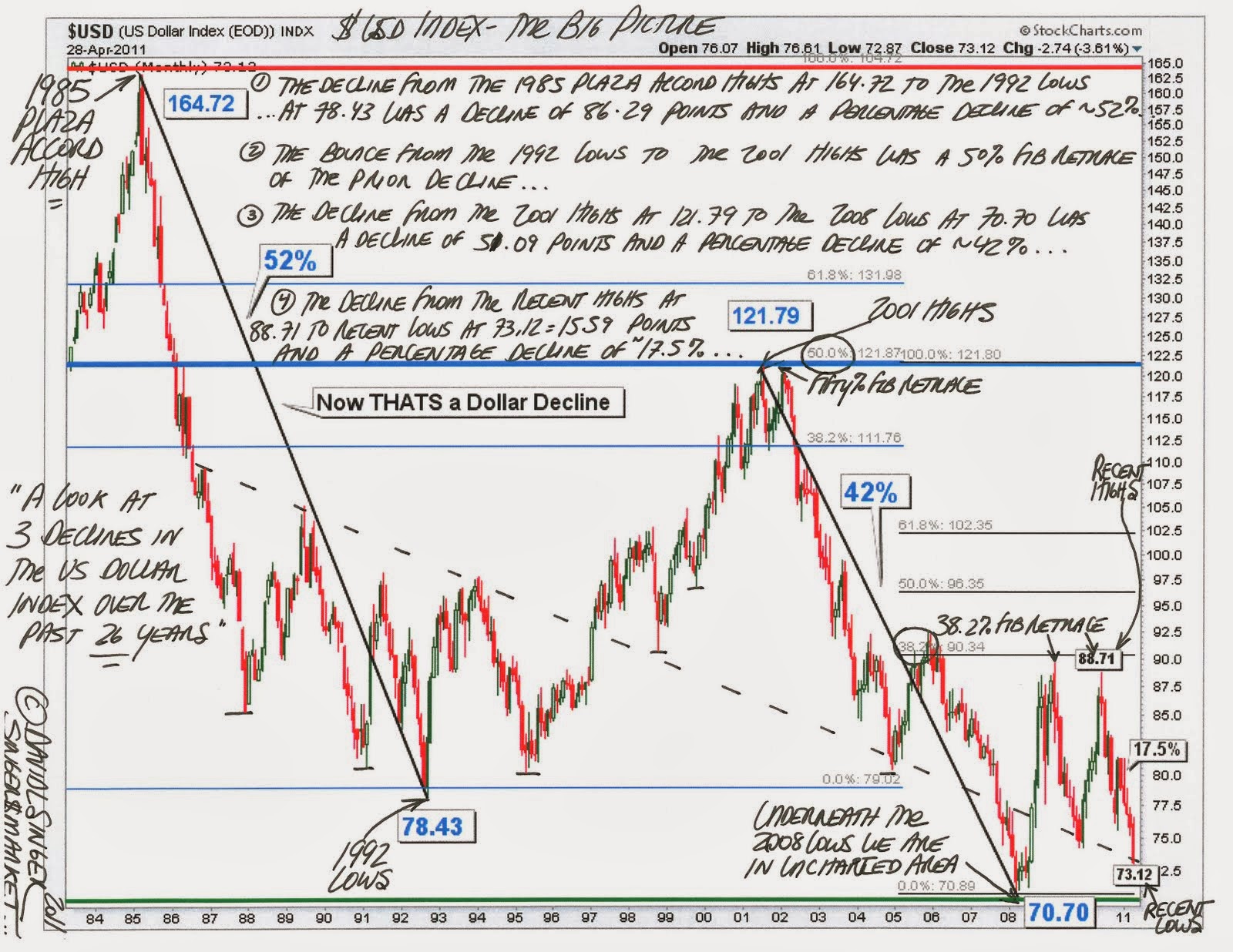

You've gotta be careful with timeframes, too. A one-minute chart is basically noise—it's high-frequency algorithms fighting each other over milliseconds of news lag. A monthly chart, though? That’s where the history is written. That’s where you see the "King Dollar" era of the early 1980s or the long slide after the 2008 financial crisis.

Interest Rates: The Gravity of the Financial World

Money flows where it is treated best. It’s a simple rule. If the Federal Reserve keeps interest rates at 5% while the European Central Bank is at 3%, where do you think big institutional investors want to park their cash?

They want the 5%.

To get that 5% in U.S. Treasuries, they have to buy dollars. This massive demand pushes the line on your u s dollar chart higher. It’s basically physics. When the Fed signals they might cut rates, the chart usually starts to droop long before the actual cut happens. The market "prices it in." They're always looking six months ahead, trying to guess the next move.

Real Examples of Chart Volatility

Let’s look at 2022. It was a wild year for the greenback. While the rest of the world was reeling from geopolitical shocks, the Fed was aggressively hiking rates. The DXY shot up to levels we hadn't seen in two decades.

People were panicking.

But look at what happened toward the end of that year. The chart hit a massive "resistance" level—a price point where sellers historically outweigh buyers. Even though the news was still "good" for the dollar, the chart couldn't break through. It’s like a runner hitting a wall. Understanding these technical levels is just as important as reading the Wall Street Journal.

The "Safe Haven" Trap

There is this weird thing that happens during global crises. It's called the "Safe Haven" bid. When things get scary—wars, pandemics, bank failures—investors run back to the dollar. They don't care if the U.S. has a high deficit or political bickering. They want the liquidity.

You can see this clearly on a u s dollar chart during the onset of COVID-19 in March 2020. There was a violent spike. Everything else was crashing, but the dollar was being hoarded. Everyone needed greenbacks to pay off debts and settle trades.

Then, the Fed pumped trillions into the system.

The chart reversed almost instantly. Supply went up, and the value tanked. If you were only looking at the news and not the chart, you would have been caught on the wrong side of that trade for months.

How to Actually Use This Information

Stop obsessing over the daily wiggles. If you’re trying to manage a business or your personal investments, look at the 200-day moving average.

It’s a long, smooth line that filters out the daily drama. If the current price is above that line, the dollar is in a "bullish" phase. If it’s below, it’s "bearish." Honestly, it’s one of the few indicators that actually works consistently because so many big players use it to make decisions.

Don't Ignore the "Double Top"

In technical analysis, a "Double Top" looks like the letter M. It’s a sign that the dollar tried to reach a new high twice and failed both times. When you see this on a u s dollar chart, it’s often a warning that a long-term trend is about to flip.

💡 You might also like: Six Principles of Communication: Why Your Message is Getting Lost

It’s not magic. It’s just human psychology. Buyers got exhausted. They weren't willing to pay more than the previous peak. Once that realization sets in, the selling starts, and it can get ugly fast.

The Geopolitical Shift: Is De-dollarization Real?

You’ve probably heard people talking about "de-dollarization" lately. Countries like Brazil, Russia, India, China, and South Africa (the BRICS) are trying to use their own currencies more.

Does the u s dollar chart show this?

Kinda. But not as much as the headlines suggest. While the share of global reserves held in dollars has slowly ticked down over the last twenty years, the dollar still dominates over 80% of global trade finance.

The chart reflects this dominance. Even when people say they want to move away from the dollar, when the world economy gets shaky, they still come crawling back to the greenback. There just isn't another currency with the same level of transparency and liquidity. Not the Euro, certainly not the Yuan.

Inflation’s Sneaky Role

Most people think high inflation makes a currency weaker. That’s true in the long run (think Weimar Republic or modern-day Venezuela). But in the short term, high inflation often makes the u s dollar chart go up.

Why? Because the market expects the Fed to raise rates to fight that inflation.

📖 Related: 1 Saudi Riyal to Egyptian Pound Rate: Why the Numbers Keep Moving

It's a weird paradox. Bad news for the consumer (higher prices) becomes "good" news for the currency value because of the expected central bank reaction. This is why you'll see a chart spike the second a "hot" CPI (Consumer Price Index) report is released.

Practical Steps for Managing Dollar Exposure

If you’re watching the dollar because you’re traveling, investing, or running a business, you need a plan that doesn't involve guessing.

- Watch the 10-Year Treasury Yield. The dollar and bond yields usually move in the same direction. If yields are climbing, the dollar is likely to follow.

- Use Limit Orders. If you need to exchange a large amount of money, don't just take whatever the bank gives you today. Look at the u s dollar chart, identify a recent "low" point, and set an order to buy there.

- Diversify, but don't over-react. Don't dump all your assets because of a "death cross" on a chart. These are signals, not certainties.

- Pay attention to the "Carry Trade." When the dollar is stable and rates are high, investors borrow in "cheap" currencies (like the Yen) to buy dollars. If the dollar starts to drop, these people all rush for the exit at once, causing a massive crash.

The most important thing is to remember that the dollar is a global barometer. It’s not just a piece of paper; it’s a reflection of global trust, interest rate differentials, and geopolitical stability.

Always look at the big picture. One day of green candles doesn't mean a new era has begun. Check the weekly charts. Look at the volume. Understand who is buying and why. The trend is your friend until it isn't, and the chart will usually tell you it's leaving long before the news anchors do.