Honestly, if you look at a ukraine rare earth minerals map today, you aren't just looking at geology. You're looking at a high-stakes poker game where the chips are worth trillions. For decades, these deposits were basically a footnote in Soviet textbooks. Now? They are the reason why CEOs in Detroit and generals in Washington are losing sleep.

Ukraine is sitting on a literal goldmine—well, a "rare earth" mine—that could fundamentally shift how the West builds everything from F-35 fighter jets to the battery in your iPhone. But here's the kicker: having the minerals on a map and getting them out of the dirt are two very different things, especially when a good chunk of them are currently under the treads of Russian tanks.

The "Ukrainian Shield" and Why Geologists are Geeking Out

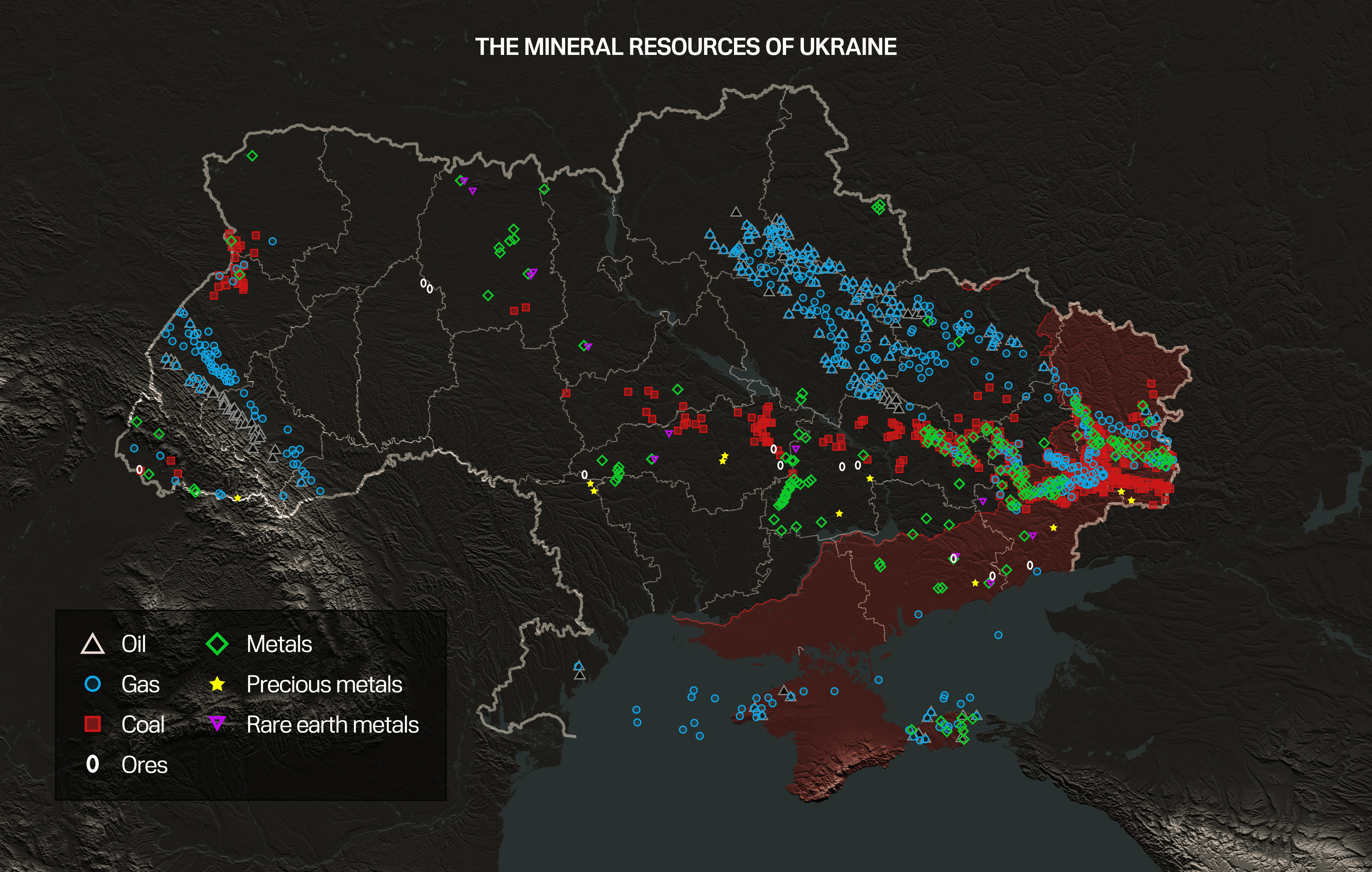

Most of the action happens in a geological formation called the Ukrainian Shield. It’s this massive slab of ancient crystalline rock that runs right through the center of the country. Think of it as the backbone of Ukraine’s mineral wealth.

Geologists have identified over 20,000 deposits of different minerals here. Out of the 34 minerals the EU considers "critical," Ukraine has 22 of them. We’re talking about the heavy hitters: lithium, beryllium, zirconium, and tantalum.

The Big Deposits You Need to Know

If you were to circle the most important spots on a map right now, your pen would probably land on these three:

- Azov (Donetsk Region): This is the "big one." It’s a massive zirconium and rare earth deposit. Before the war, experts compared it to the Mountain Pass mine in the US. The tragedy? It’s currently in an area heavily impacted by the frontline.

- Mazurivske (Donetsk): Another titan. It’s packed with tantalum and niobium—stuff used to make capacitors for high-end electronics.

- Perga (Zhytomyr Region): Located in the north, this is one of the few major deposits in a relatively "safer" zone. It’s famous for beryllium, which is essential for the aerospace and defense industries.

Why the Map is Shifting in 2026

The map isn't static. It changes every time the frontline moves. As of early 2026, the situation is... complicated. Basically, about 20% of Ukraine’s territory is occupied, but that 20% holds nearly half of the country’s rare earth potential.

Russia knows this. They aren't just fighting for land; they are fighting for the periodic table. By controlling the Donbas, they effectively "lock" Ukraine out of its most profitable future exports. It’s a classic resource grab disguised as a territorial dispute.

The "Rare Earths for Aid" Deal: A New Reality

You’ve probably heard about the deals happening behind closed doors. In 2025, the U.S. and Ukraine launched a joint Reconstruction Investment Fund. The vibe is pretty clear: Western capital and military support in exchange for long-term access to these minerals.

It’s a bit of a "Dig, Baby, Dig" strategy for the 21st century.

- Lithium is the star: Everyone wants Ukraine's lithium (estimated at 500,000 tons). In January 2026, the Dobra deposit in Kirovohrad was officially awarded to a U.S.-linked group. That’s a $179 million investment right out of the gate.

- The EU is sweating: Brussels is worried they're being sidelined. They need these minerals for their "Green Deal," but the U.S. is moving faster to secure the licenses.

- Graphite is the dark horse: Ukraine holds about 20% of the world’s graphite. If you want to build an EV battery without relying 100% on China, you need Ukraine.

Misconceptions: It’s Not Just About "Rare" Earths

One thing people get wrong is the name. "Rare earths" aren't actually that rare in the Earth's crust. They're just rare to find in concentrations that are profitable to dig up. Ukraine has the concentration.

However, the "map" you see in news reports often uses Soviet-era data. Back then, they didn't care about environmental standards or whether a mine was actually profitable. They just wanted the rocks. Modern investors are having to redo the homework. They are discovering that while the minerals are there, the infrastructure—roads, power lines, processing plants—is often non-existent or destroyed.

What This Means for the Global Market

If Ukraine can actually start exporting at scale, it breaks the monopoly. Currently, China controls about 70% of rare earth processing. If a ukraine rare earth minerals map eventually turns into a network of active mines, the "China leverage" starts to evaporate.

That’s why this is more than just a local business story. It’s a global power shift.

🔗 Read more: Why Washington Post Newspaper Circulation Numbers Tell a Bigger Story Than You Think

Actionable Insights for 2026

If you're looking at this from a business or investment perspective, keep your eyes on these three things:

- Follow the Licenses: The Ukrainian State Geological Service is increasingly moving toward transparent online auctions. Watch for "Dobra Lithium" and "Perga Beryllium" as benchmarks for how fast extraction can actually happen.

- Infrastructure is the Bottleneck: Don't just look at the mineral location. Look at the proximity to the power grid. A lithium deposit is useless if there's no high-voltage line to run the machinery.

- The "De-Risking" Factor: The real winners won't be the companies that find the minerals, but the companies that provide the security and insurance to operate in a semi-active conflict zone.

The map is a promise of wealth, but the shovel is still hitting the ground. Keep an eye on the Kirovohrad and Zhytomyr regions—they are the most likely to see the first "new era" mines go live before the decade is out.