Money feels fake lately. You tap a piece of plastic against a terminal, a chip or NFC reader pings, and numbers move from one digital bucket to another. It’s easy to assume physical cash is dying. But if you look at the actual data from the Federal Reserve, the amount of US dollars in circulation tells a completely different story. It is ballooning.

In fact, there is more physical green paper out there right now than at almost any point in American history. It’s weird. We use it less for groceries, yet the printing presses at the Bureau of Engraving and Printing haven’t cooled off. As of late 2024 and heading into 2025, the total value of currency in circulation has hovered around $2.3 trillion.

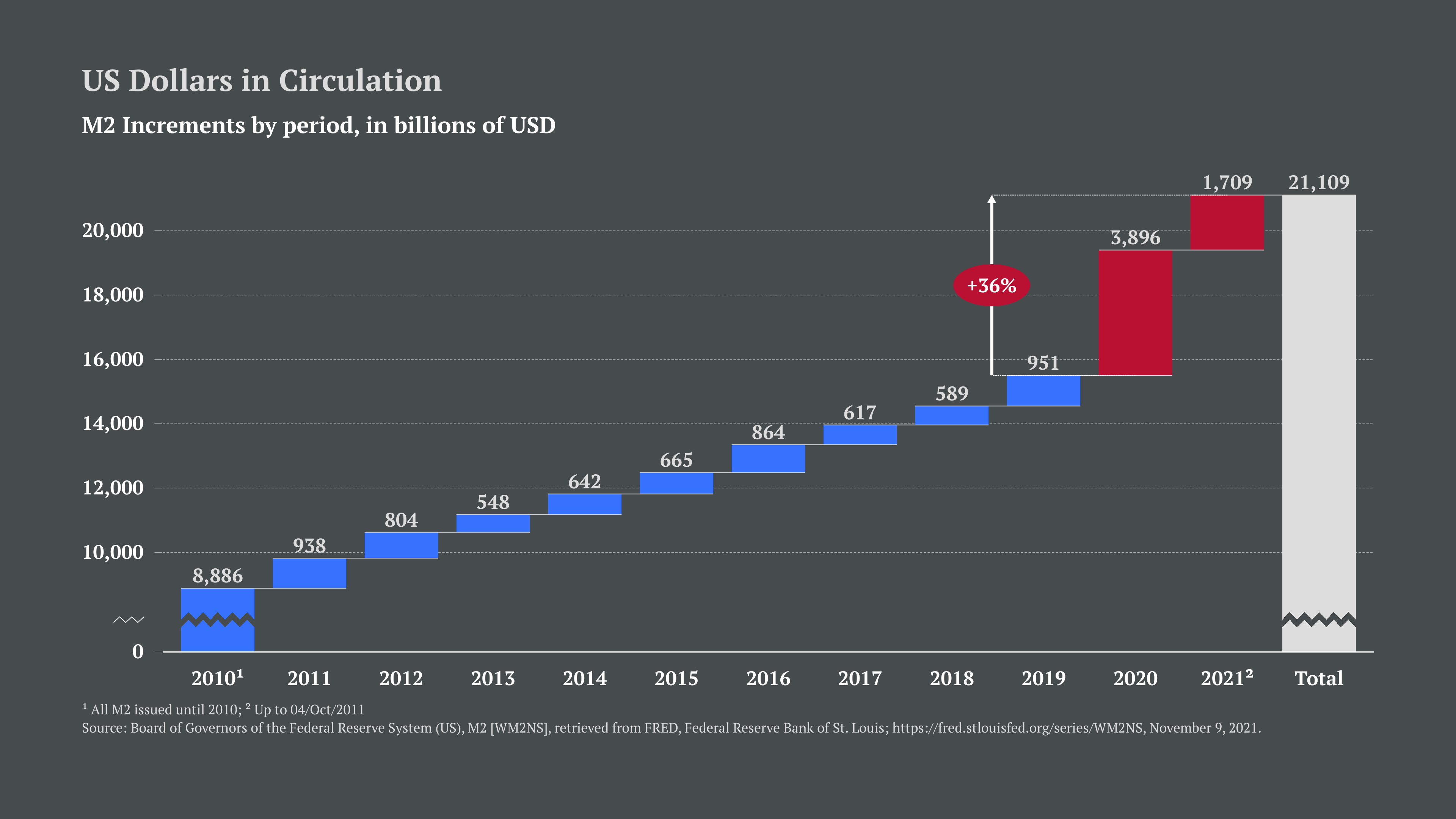

That is a massive number. To put it in perspective, back in 2010, that figure was closer to $900 billion.

Where is all the cash hiding?

If you aren't carrying a wad of twenties, who is? Most people assume the "money supply" is just what sits in bank vaults or the registers at Walmart. Not even close. A huge portion of US dollars in circulation isn't even in the United States.

Economists like Ruth Judson at the Federal Reserve have spent years tracking this. Her research suggests that roughly 60% of all US bills—and about 75% of $100 bills—are actually held abroad.

🔗 Read more: Motilal Oswal Finance Share Price: Why Everyone is Watching This Stock in 2026

Why? Because the dollar is the world’s "Mattress Money."

When a central bank in a developing nation sees its local currency collapse due to inflation, the citizens don't buy Bitcoin—at least not primarily. They buy Benjamins. They tuck $100 bills into floorboards or safe deposit boxes in places like Argentina, Turkey, and across Russia. The US dollar is the ultimate insurance policy. It’s a physical asset that doesn't require a functional local banking system to hold its value.

The C-Note Paradox

There is a funny thing about the $100 bill. It is now the most frequently printed note in the US Treasury's arsenal. It actually overtook the $1 bill in circulation volume a few years ago.

This is what experts call the "C-Note Paradox." We almost never use $100 bills for daily transactions. Try buying a pack of gum with one at a gas station and see the look the clerk gives you. Yet, they are the most in-demand physical export the US has.

- Store of Value: Large denominations are easier to hide or transport.

- The Shadow Economy: Let's be honest. Cash is anonymous. Whether it's "under the table" construction work or more illicit activities, high-value notes are the grease for the gears of the unrecorded economy.

- Safety Netting: During the 2020 pandemic, the amount of cash in circulation spiked. People got scared. When humans get scared, they want something they can touch.

How the Federal Reserve actually tracks the money

The Fed doesn't just guess. They track every pallet of cash that leaves their 28 cash offices across the country.

They use a system called the "Currency Education Program" and work with the Secret Service to monitor the health of these bills. When you deposit a torn, oily $5 bill at your local bank, that bank eventually sends it to the Fed. The Fed shreds it and issues a crisp new one to keep the total US dollars in circulation balanced with demand.

📖 Related: Frito Lay Net Worth: Why the Snack Giant is More Valuable Than You Think

But demand isn't a straight line. It's seasonal.

Money demand usually spikes right before the winter holidays. People give cash as gifts. Retailers need more "making change" money in the drawers. Then, in January, that money floods back into the banks, and the "in circulation" numbers dip slightly as the Fed pulls the worn-out notes out of the system.

The "War on Cash" is mostly marketing

You’ve probably heard tech CEOs talk about a cashless society. They want that. Every time you use an app, they get a slice of the transaction fee. Visa and Mastercard love the idea of a cashless world.

But the US government is surprisingly hesitant.

The reason is simple: Seigniorage. That is a fancy word for the profit the government makes by printing money. It costs about 17 cents to print a $100 bill. The government then "sells" that bill to banks at face value. That's a huge margin. If physical US dollars in circulation disappeared, the Treasury would lose a massive, interest-free loan from the public.

The Digital Dollar vs. Physical Cash

There is a lot of chatter about a Central Bank Digital Currency (CBDC). Some people think this will replace physical cash.

It won't. Or at least, not anytime soon.

Jerome Powell, the Fed Chair, has stated repeatedly that any digital dollar would have to coexist with physical currency. There are millions of Americans who are "unbanked." They don't have accounts. They rely entirely on the physical US dollars in circulation to survive. Removing cash would effectively kick the most vulnerable people out of the economy.

Also, there's the privacy issue.

👉 See also: Robert Kapito Net Worth: What Most People Get Wrong

If I buy a used bike from you for $200 in cash, the government doesn't know. If I use a CBDC, every single transaction is on a ledger. There is a massive segment of the population—across all political spectrums—that finds that level of surveillance creepy.

Why the total keeps going up even with inflation

Inflation usually makes people want to hold less cash because the purchasing power is dropping. If inflation is 7%, your $100 is worth $93 a year from now.

However, the raw number of US dollars in circulation keeps rising because as prices go up, you need more physical units to complete the same transaction. If a burger costs $15 instead of $8, the economy literally needs more physical bills in the ecosystem to function.

Real-world implications for your wallet

So what does this mean for you?

First, ignore the "cash is worthless" doomsday preppers. While inflation eats at the value, the sheer global demand for the US dollar ensures it remains the world’s primary reserve. If the $100 bill was going anywhere, the Fed wouldn't be printing billions of them every year.

Second, recognize that cash is a privacy tool. In an era of data breaches and "de-banking," having a physical stash is just practical.

Steps to take based on the current currency landscape:

- Keep a "Disruption Stash": Most financial experts suggest having $500 to $1,000 in physical cash in a fireproof safe. If the power goes out or a bank's digital network gets hacked, your credit card is a brick. Physical US dollars in circulation are the only thing that will work.

- Watch the DXY: The Dollar Index (DXY) tells you how the USD is performing against other currencies. When the dollar is "strong," the demand for physical bills abroad usually increases.

- Check your old bills: The Fed is constantly updating security features. If you have "small head" $100 bills from the early 90s, they are still legal tender, but some overseas exchanges won't take them anymore because they lack modern anti-counterfeiting tech. Swap them for newer "big head" notes at your bank.

- Understand the "Velocity of Money": Just because there's a lot of cash doesn't mean it's moving. If people are hoarding it, the economy can feel slow even if the money supply is huge.

The reality of US dollars in circulation is that the greenback is more like a global commodity than just a medium of exchange. It's a product manufactured by the US, used by the world, and stored in the dark corners of the globe as a hedge against chaos. As long as the world is a messy, unpredictable place, the demand for those physical strips of linen and cotton isn't going anywhere.

Cash isn't just king. It's the entire castle.