Tax season is basically the adult version of waiting for a report card you didn’t study for. You see a number, you feel a pang of dread, and you wonder why the government is taking such a massive bite out of your paycheck. But honestly? Most people fundamentally misunderstand how us federal income tax brackets actually work. There is this persistent, nagging myth that if you get a raise and "bump" into a higher bracket, you might actually end up taking home less money.

That’s just wrong. Flat out.

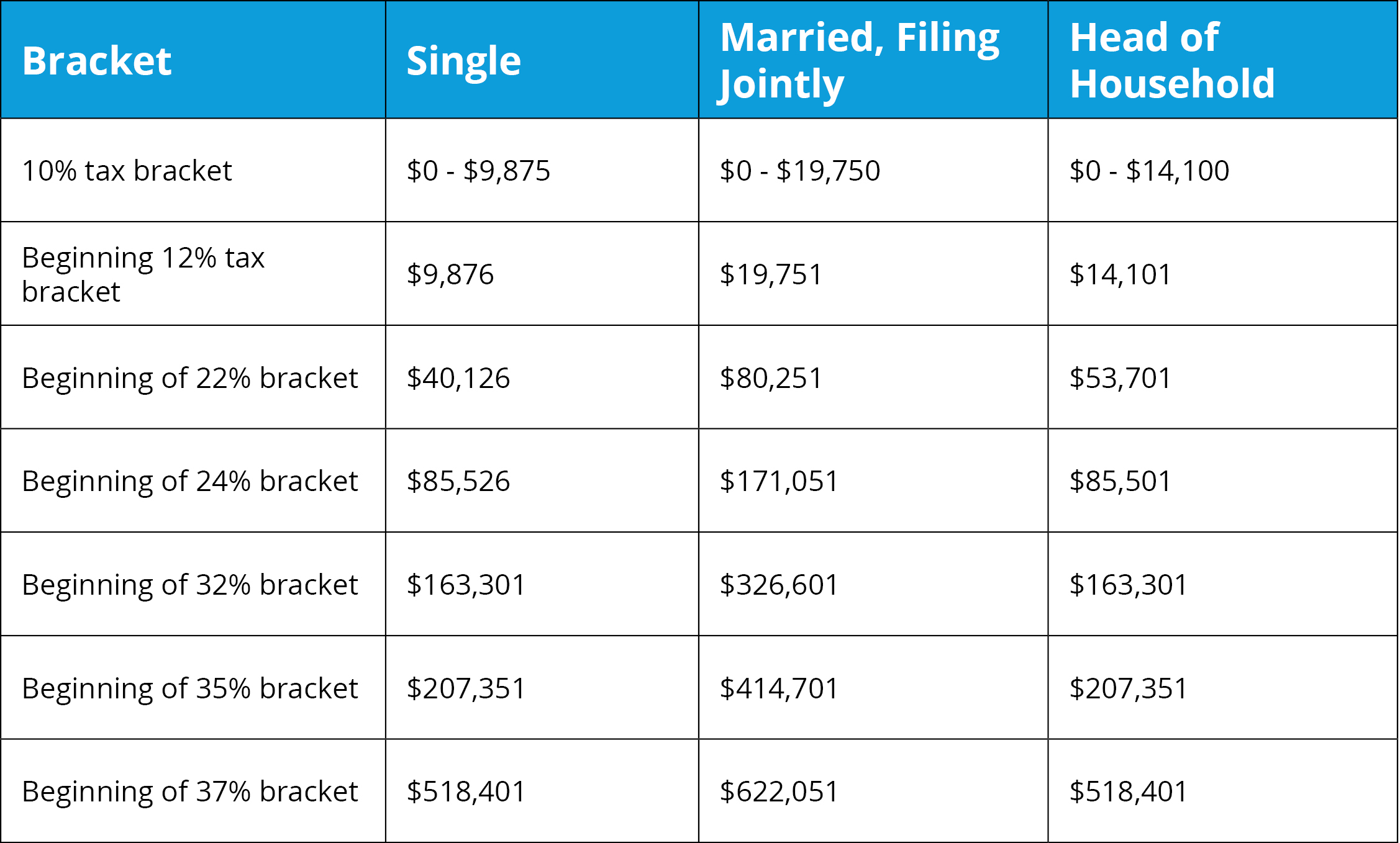

The US uses a progressive tax system. Think of it like a series of buckets. You don’t just dump all your money into the highest bucket you reach. Instead, you fill the first one, then the overflow goes into the next, and so on. Understanding this isn't just about being a math nerd; it’s about not being afraid of making more money.

The Math Behind US Federal Income Tax Brackets

Let’s talk about the 2025 and 2026 shifts. Since we are looking at the 2025 tax year (the taxes you’ll likely be worrying about right now), the IRS adjusted the brackets to account for inflation. This is what they call "bracket creep" prevention. If they didn't do this, your cost-of-living raise would actually result in a standard of living decrease because you'd be paying a higher percentage in taxes without actually having more "real" wealth.

For a single filer in 2025, the 10% bracket covers the first $11,925 of taxable income. If you earn $11,926, only that last dollar is taxed at 12%. You aren't suddenly paying 12% on the whole $11k. This is a massive distinction. People freak out about the 22%, 24%, or the dreaded 37% top rate, but your effective tax rate—the actual percentage of your total income that goes to Uncle Sam—is always lower than your top marginal bracket.

Take a look at how this breaks down for the current filing year. If you're single and your taxable income is $50,000, you aren't just in the 22% bracket. You’re spread across three. You pay 10% on the first chunk, 12% on the middle chunk, and 22% only on the amount over $48,475.

💡 You might also like: Koninklijke Philips Share Price: What Most People Get Wrong

Why the Standard Deduction Changes the Game

Before you even look at the us federal income tax brackets, you have to subtract the standard deduction. For 2025, that’s $15,000 for singles and $30,000 for married couples filing jointly.

That money is essentially "invisible" to the IRS.

If you earn $60,000 as a single person, you aren't being taxed on $60,000. You subtract that $15,000 first. Now you’re looking at a taxable income of $45,000. This puts your top dollar in the 12% bracket instead of the 22% bracket. It’s a huge swing. Tax planning isn't just for billionaires with offshore accounts in the Caymans; it’s basically just knowing which "invisible" piles of money you're allowed to keep.

The 2026 Sunset Clause: What Nobody Is Talking About Yet

We are currently living under the rules of the Tax Cuts and Jobs Act (TCJA) of 2017. But here’s the kicker: many of these provisions are set to expire at the end of 2025. Unless Congress acts—which, let’s be real, is always a coin toss—we might see a return to the old, higher rates in 2026.

Back then, the brackets were 10%, 15%, 25%, 28%, 33%, 35%, and 39.6%.

Compare that to today’s 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

If the sunset happens, almost everyone will see their marginal rate tick up. The 12% bracket might jump back to 15%. The 22% might go back to 25%. It sounds small, but over a full year of earnings, that’s a vacation, a car payment, or a significant chunk of a retirement contribution. Planning for 2026 means realizing that the us federal income tax brackets you see today might be the "discount" version of what’s coming next.

Capital Gains vs. Ordinary Income

Not all money is created equal. If you work a 9-to-5, your income falls into those standard brackets we just discussed. But if you sell stock or a house? That’s often Long-Term Capital Gains.

👉 See also: The Real Reason Everyone is Talking About SINT (And Why It Matters)

The rates there are much friendlier: 0%, 15%, or 20%.

A lot of people don’t realize that you can actually earn a decent amount of money through investments and pay 0% in federal taxes on those gains if your total taxable income stays below a certain threshold (around $47,000 for singles in 2025). This is why the "rich" seem to pay less. It’s not always shady loopholes; it’s often just the way the brackets are structured to favor investment over labor.

Marginal vs. Effective: The Great Confusion

I was talking to a friend the other day who turned down a weekend overtime shift. He said, "If I take it, it’ll push me into the next tax bracket and I’ll make less than if I stayed home."

I had to stop him. It’s a total myth.

Even if that overtime pay is taxed at 24% instead of 22%, you are still keeping 76 cents of every dollar. In the old 22% bracket, you were keeping 78 cents. You are never, ever worse off by making more money in the US tax system. The only exception is if you hit a "benefits cliff" where you lose government subsidies for healthcare or childcare, but as far as the us federal income tax brackets are concerned, more is always more.

Common Deductions That Shrink Your Taxable Footprint

You want to pay less? You have to lower the number the IRS sees. You do that through adjustments to income, sometimes called "above-the-line" deductions.

- Traditional 401(k) or IRA contributions: This is the big one. If you put $5,000 into a traditional 401(k), the IRS acts like you never earned that $5,000 in the first place.

- HSA Contributions: Health Savings Accounts are the "triple threat" of tax savings. Tax-free in, tax-free growth, tax-free out for medical stuff.

- Student Loan Interest: You can deduct up to $2,500 of interest paid, even if you don't itemize.

These aren't just "nice to haves." They are mechanical levers you can pull to shift which of the us federal income tax brackets your top dollars fall into.

The Marriage Penalty (and Bonus)

Marriage changes things. If one spouse earns a lot and the other earns very little, filing jointly usually results in a "marriage bonus." The lower earner pulls the higher earner's income down into lower brackets.

However, if both spouses are high earners—say they both make $400,000—they might hit the "marriage penalty." The combined income could push them into the 37% bracket faster than if they had stayed single. The IRS tries to balance this, but it’s imperfect.

Actionable Steps for Your Tax Strategy

Don't just wait for your W-2 to arrive in the mail and hope for the best. Tax planning is a year-round sport.

First, check your withholding. If you’re getting a $5,000 refund every year, you’re basically giving the government an interest-free loan. That’s money you could have put into a high-yield savings account or used to pay down debt. Adjust your W-4 with your employer to get that number closer to zero.

Second, look at your retirement contributions. If you are on the edge of the 22% bracket, contributing just a bit more to a traditional 401(k) can keep your income in the 12% range. That’s an immediate 10% "return" on your money just in tax savings.

Third, keep an eye on the 2026 legislative changes. If the TCJA expires, you might want to consider "harvesting" some capital gains now while the rates are lower.

The us federal income tax brackets are a roadmap, not a trap. Once you stop viewing them as a flat penalty and start seeing them as a series of steps, you can start moving through them much more effectively. Taxes are inevitable, but paying more than your fair share because of a misunderstanding of the math is totally optional.

Maximize your "above-the-line" deductions, understand your effective rate, and stop fearing the "next" bracket. It’s your money; keep as much of it as the law allows.