Waiting for a paycheck feels like watching a slow-motion car crash sometimes, especially when bills are due and your balance is hovering near single digits. If you're a USAA member, you've probably heard that they're legendary for "early pay," but there is a massive difference between what people say on Reddit and how the bank's automated systems actually process those ACH files. Basically, the USAA direct deposit schedule isn't just a static calendar; it’s a dance between the Federal Reserve, your employer's payroll department, and USAA’s internal processing cycles.

You’re likely here because it’s 3:00 AM and your money isn't there yet. Or maybe you're trying to plan a mortgage payment and need to know if "one day early" is a guarantee or just a suggestion.

Let's get real. USAA typically makes funds available up to two days before your actual scheduled payday. This isn't magic. It's because USAA is willing to credit your account as soon as they receive the "intent to pay" notification from your employer’s bank. While big banks like Chase or Wells Fargo often sit on that money to earn a little extra interest (called "the float"), USAA just hands it over. But—and this is a big "but"—if your employer is late sending that file, USAA can't give you money they don't know exists yet.

How the USAA Direct Deposit Schedule Actually Functions

Most people think money moves instantly. It doesn't.

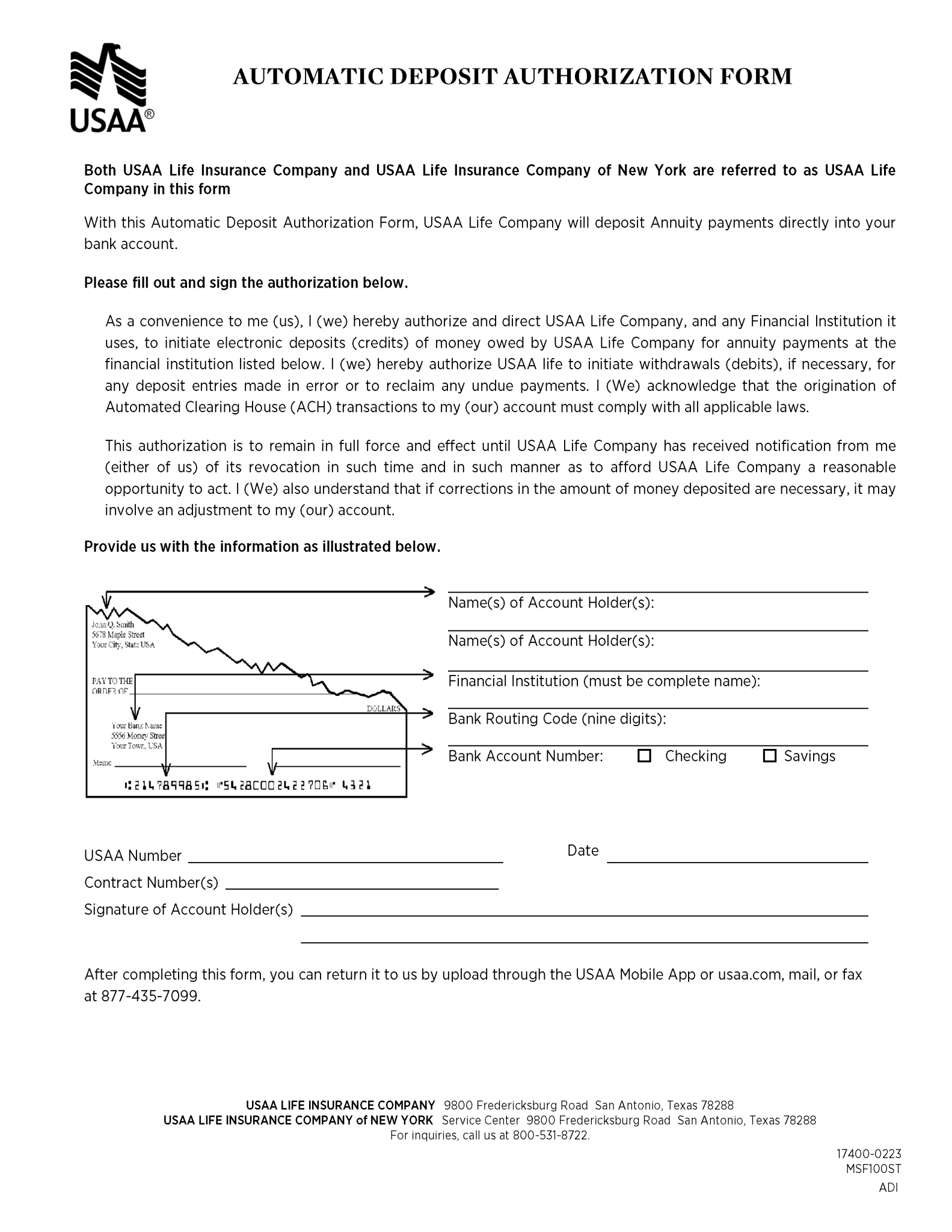

When your boss clicks "send" on payroll, that data travels through the Automated Clearing House (ACH) network. This network is old. It's reliable, but it’s definitely not fast. Usually, for a Friday payday, an employer sends the file by Wednesday. USAA sees that file on Wednesday night or Thursday morning. Because they trust the federal government and most major employers, they essentially front you the cash.

✨ Don't miss: Who is John Maynard Keynes and why does he still run the world economy?

They do this because they want your loyalty. It works.

However, the USAA direct deposit schedule is heavily dictated by federal holidays. If Monday is a holiday, everything shifts. If the Federal Reserve is closed, the "pipes" are clogged. You can't move water through a frozen pipe, and you can't move digital dollars through a closed Fed. Honestly, this is where most of the frustration happens. Members see a "Friday" payday and expect money Thursday, but if Monday was Veterans Day, that Thursday arrival might suddenly become Friday morning.

The Military Pay Factor

If you are active duty, the stakes are higher. Military pay is remarkably consistent, but it follows the 1st and the 15th of the month. If those dates fall on a weekend or a holiday, the DFAS (Defense Finance and Accounting Service) adjusts the schedule.

USAA generally posts military pay one business day before the actual scheduled military payday. For instance, if the 15th is a Monday, the official payday might be that Monday, but USAA members often see that money hitting their available balance on the previous Friday. That is a three-day jump if you count the weekend. It feels like a win, but you have to remember that your next pay cycle is now effectively longer. You’re stretching those dollars over 17 days instead of 14.

Why Your Deposit Might Be "Late"

Is it actually late? Usually not.

Most of the time, a delay in the USAA direct deposit schedule comes down to the employer's payroll provider. If you work for a small business that uses a platform like Gusto or Zenefits, and the HR person forgets to hit "submit" by the 2:00 PM cutoff on Tuesday, USAA won't get the file until Thursday. In that scenario, you're getting paid Friday morning just like everyone else. No early bird special for you.

- The "Pending" Status: Sometimes you'll see the deposit in your "Pending" transactions. This means USAA has the data but hasn't finalized the "Available Balance."

- The Midnight Myth: There is no universal "midnight" drop. Some deposits hit at 2:00 AM CST, others at 6:00 AM. It depends on when the batch file was processed.

- New Accounts: If you just opened your USAA account, your first few direct deposits might take a full cycle to trigger the "early" release. The system is essentially vetting the legitimacy of the incoming funds.

Surprising Nuances of the ACH Process

Many people don't realize that USAA doesn't technically have to give you that money early. It is a courtesy. In the fine print of almost every banking agreement, the bank reserves the right to hold funds until the actual settlement date.

The settlement date is the day the money is officially transferred between banks. If your payday is Friday, the settlement date is Friday. When USAA gives it to you on Thursday, they are taking a micro-risk that the check might bounce or the file might be retracted. For a giant like the DoD, that risk is zero. For "Joe’s Construction Shack," the risk is slightly higher, but USAA’s algorithms are usually smart enough to handle it.

Another thing: Don't rely on the "early" pay for automated bill draws.

If you have your electric bill set to pull on Thursday because you usually get paid Thursday, you are playing a dangerous game. If a federal holiday or a clerical error at your job pushes that deposit to Friday, you’re looking at an NSF fee. USAA is pretty forgiving, but they aren't a charity. They will charge you if that bill hits an empty account, even if the deposit arrives four hours later.

📖 Related: Rey’s Parts & Sales: Why This Small-Town Junkyard Is a Big Deal for Car People

Timing by the Clock

While USAA is headquartered in San Antonio (Central Time), their processing servers don't always sleep when Texas does. Most members report that if a deposit is coming a day early, it shows up between 12:00 AM and 5:00 AM Central Time. If you wake up at 7:00 AM and it isn't there, checking every ten minutes isn't going to make it appear. The next "batch" update usually doesn't happen until the following business day or a mid-day refresh, though mid-day hits are rarer for standard payroll.

Practical Steps to Manage Your USAA Pay Cycle

Relying on a specific hour for your money is a recipe for stress. You can actually take a few steps to make this less of a headache.

First, set up text alerts. Don't sit there refreshing the mobile app. Go into your communication preferences and toggle on the "Deposit" notification. USAA will ping you the second the funds move from "Pending" to "Available." It saves your thumb the effort of swiping down and saves your brain the hit of dopamine-fueled anxiety.

Second, always keep a "buffer" of at least $50 to $100 in the account. This sounds like basic advice, but it's the only real defense against a slight shift in the USAA direct deposit schedule. If a holiday pushes your pay by 24 hours, having enough for gas or a grocery run makes that delay a minor annoyance rather than a crisis.

Third, look at the calendar for the entire year. Identify the "long" pay periods. If you get paid on a Friday and the next payday is pushed because of a Monday holiday, you might find yourself with a 16-day gap between checks. Map these out in January so you aren't surprised in October.

💡 You might also like: Goldman Sachs Announces Cloud Service Provider Deal: What Really Happened

The Reality of Bank Transfers and Holidays

We need to talk about the "Holiday Shift" because it’s the number one reason people call USAA customer service. Here is a quick breakdown of how it usually goes:

If the holiday is on a Monday:

The Federal Reserve is closed. No files move. If your payday was supposed to be Tuesday, you will almost certainly not see that money early. You will likely see it on Tuesday or even Wednesday.

If the holiday is on a Friday:

Most employers move payday to Thursday. In this case, USAA often releases the funds on Wednesday. These "double-early" weeks are great until you realize you have to wait an extra-long time for the next check.

Actionable Insights for USAA Members

Stop treating the early deposit as a guarantee. Treat it as a bonus. The most successful way to handle your finances with USAA is to budget as if you get paid on the actual date your employer mandates.

- Audit your payroll department: Ask your HR person exactly when they submit the ACH files. If they submit them late, you will never get your money early, regardless of USAA's policies.

- Verify your "Standard" Payday: Know the difference between your "USAA Payday" and your "Actual Payday." If your company says you get paid on the 15th and 30th, those are your legal anchors.

- Use the "Move Money" Tool: If you have multiple accounts, set your internal transfers (like moving money to savings) to trigger one day after your expected early deposit. This gives you a 24-hour safety net.

- Check the Federal Reserve Calendar: Bookmark the list of standard bank holidays. If the Fed is closed, your money is sitting in a digital waiting room.

The USAA direct deposit schedule is one of the best perks of being a member, especially for those in the military community who deal with the complexities of government pay scales. By understanding that USAA is essentially giving you an interest-free, one-day loan based on a digital promise from your employer, you can better navigate the occasional delays and timing shifts that are baked into the American banking system. Keep your alerts on, keep your buffer ready, and stop refreshing the app at midnight. It'll get there when the ACH file clears.