You’ve probably seen the acronym SOFR buried in your mortgage paperwork or a business loan agreement lately. It’s everywhere. But honestly, most people have no idea what it actually represents, even though it dictates how much interest they pay every single month.

Basically, the Secured Overnight Financing Rate (SOFR) is the giant engine under the hood of the American financial system. Today, January 16, 2026, SOFR is sitting at 3.64%.

That number might seem random, but it’s the result of nearly a trillion dollars in transactions happening while you sleep. It’s not a guess. It’s not a "vibe" set by a committee in London. It is a hard, data-driven look at what it costs for big banks to borrow money when they put up U.S. Treasuries as collateral.

If you have a variable-rate loan, this is the number that matters.

What is SOFR Today and Why is it Moving?

Right now, the market is in a bit of a tug-of-war. We’ve moved past the chaos of the LIBOR transition—the old rate everyone used to use—and SOFR is now the undisputed king. But it’s a volatile king.

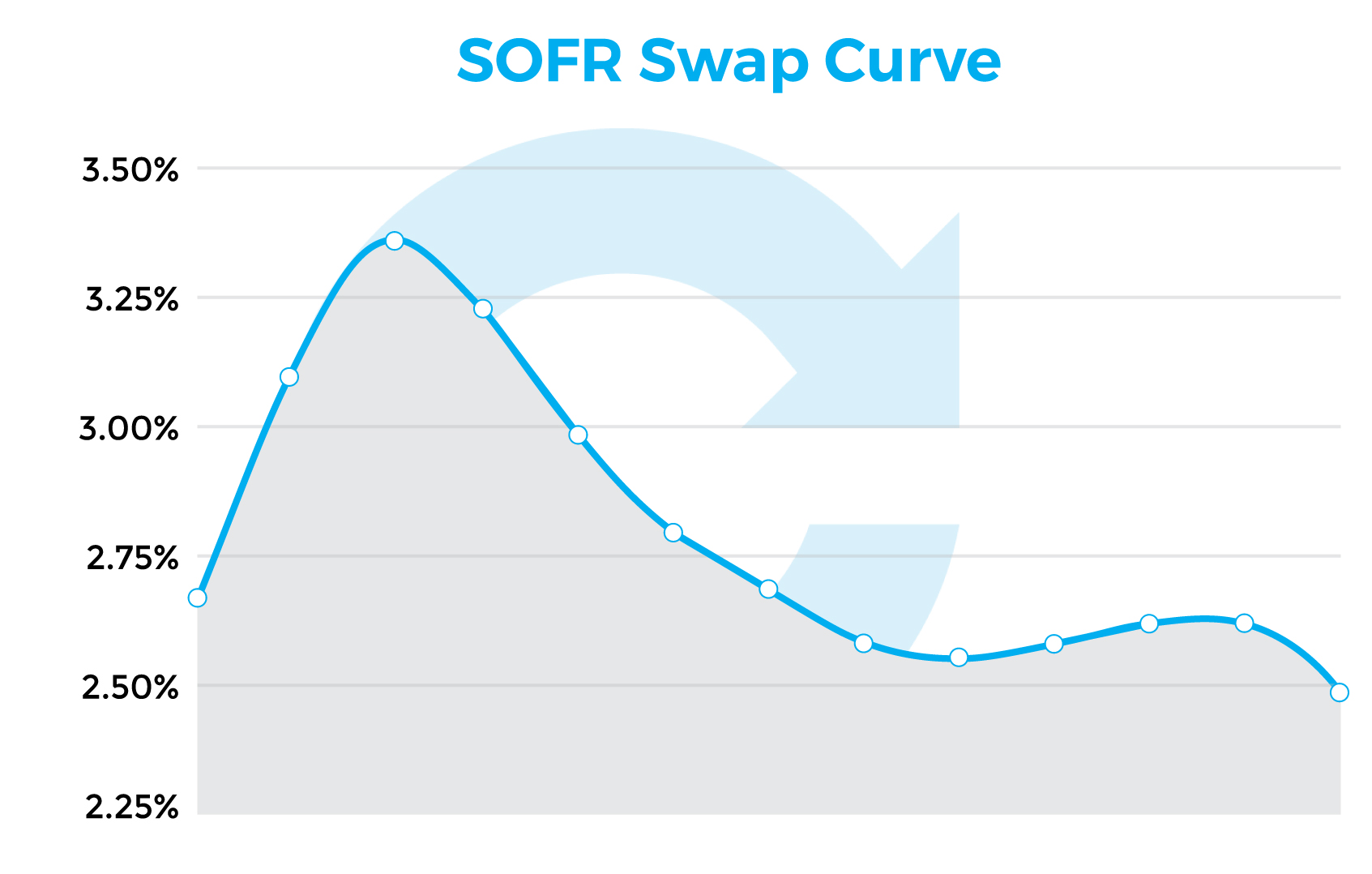

Looking at the latest data from the Federal Reserve Bank of New York, the 30-Day Average SOFR is roughly 3.70%, while the 90-Day Average is 3.93%. Notice the gap? That downward slope tells you that interest rates have been cooling off over the last few months, though the pace of that cooling is starting to level out.

Earlier this year, everyone was betting on a fast slide down to 3%. Now? Not so much.

Traders are getting a bit "hawkish." That's finance-speak for thinking rates will stay higher for longer. Since late 2025, the labor market has stayed surprisingly resilient, and inflation hasn't quite hit that "magic" 2% goal the Fed obsesses over. Because of that, the SOFR futures market—which is basically a giant betting parlor for where rates will be in six months—is starting to price in a "hold" strategy.

Don't expect your car loan or commercial credit line to get significantly cheaper by next week.

The Repo Market: Where the Magic Happens

So, how do they actually get to 3.64%? It’s based on the "repo" market.

Imagine a bank has a billion dollars in Treasury bonds but needs cash for 24 hours to cover its books. It "sells" those bonds to another institution with a promise to buy them back tomorrow for a slightly higher price. That price difference is the interest rate.

Because these loans are "secured" by the safest asset on earth (U.S. government debt), the rate is usually lower than other types of borrowing. But it can spike. If there’s a sudden shortage of cash in the system—maybe because corporate taxes are due or a big Treasury auction is happening—banks scramble for money, and SOFR jumps.

We saw this happen back in September 2025, when SOFR printed significantly higher than the Fed’s target. It was a brief panic, a "liquidity glitch," but it reminded everyone that SOFR can be a bumpy ride compared to the old, smoother LIBOR.

Why SOFR Replaced LIBOR (The Short Version)

For decades, we used LIBOR (London Interbank Offered Rate). It was based on a simple question: "Hey, big bank, what would you charge a friend to borrow money?"

The problem? Banks lied.

The LIBOR scandal proved that human-reported rates were easy to manipulate. SOFR was the solution because you can't fake a trillion dollars of actual trades. It’s transparent. It’s robust. It’s also "risk-free," which sounds great, but it means it doesn't account for the "credit risk" of a bank actually failing.

Different Flavors of SOFR

You won't always see the "Overnight" version. Most consumer products use different variations:

- Term SOFR: This is a forward-looking rate (usually 1-month or 3-month). It’s popular for business loans because it lets you know exactly what your payment will be at the start of the month.

- Compounded SOFR: This looks backward at what the rate was over the last 30 or 90 days. It’s arguably more accurate to the market, but it’s a headache for accounting.

- SOFR Index: Used by math whizzes to calculate interest over custom time periods.

Today, 1-month Term SOFR is hovering around 3.68%. If you’re refinancing a commercial property or checking an adjustable-rate mortgage, that’s likely the specific number your lender is looking at.

What This Means for Your Wallet

If you’re a borrower, the current trend is "stable but stubborn."

We aren't in the 5% world of 2024 anymore, but we aren't back to the "free money" era of 2021 either. The spread between the Effective Federal Funds Rate (3.64%) and SOFR has stayed tight, which means the plumbing of the financial system is working well right now. No major leaks.

Actionable Insights for 2026

If you’re managing debt or looking at new financing, here is what you need to do:

📖 Related: HPE Juniper Antitrust Settlement Inquiry: What Really Happened Behind Closed Doors

- Check Your "Spread": Most loans are priced as "SOFR + [a percentage]." If your loan is SOFR + 2%, you’re currently paying 5.64%. If your spread is higher than what’s being offered to new customers, it’s time to renegotiate.

- Watch the FOMC Meetings: SOFR follows the Fed. If Jerome Powell hints at a pause in rate cuts—which he’s been doing lately due to a "sticky" CPI—expect SOFR to stay flat or even tick up.

- Hedge if You’re Scared: For businesses, SOFR swaps or caps are more common now than ever. If you can’t afford for SOFR to hit 4.5% again, look into a "cap" to protect your downside.

- Understand the "Reset" Date: If you have an ARM (Adjustable Rate Mortgage), find out exactly which day your rate resets. SOFR can swing 5-10 basis points in a single day based on technical factors. A "bad" day for the repo market could cost you a few hundred dollars a year if your reset happens to land on it.

The bottom line is that SOFR is a better, more honest reflection of the U.S. economy than anything we’ve had before. It’s grounded in the reality of the Treasury market. While it might feel like just another number, it represents the actual heartbeat of global dollar liquidity.

Keep an eye on the 3.6% level. If we break below that, we’re heading for a true "soft landing." If it starts climbing back toward 4%, expect your borrowing costs to stay painful for the foreseeable future.