Honestly, if you're trying to figure out what's the current tariff on china, you’ve probably realized by now that there isn't just one single number. It’s a mess. One day you’re hearing about 10% across-the-board taxes, and the next, there’s a "truce" signed in a high-stakes meeting that changes everything for semiconductors but leaves your sneakers untouched.

As of January 2026, the trade landscape is a weird hybrid of leftover Biden-era policies and the aggressive new maneuvers from the second Trump administration. We are currently living in the "Truce of 2025" era. Last November, a deal was struck that essentially hit the pause button on the most extreme escalations, but "pause" doesn't mean "zero." You're still paying a premium on almost everything coming out of a Chinese port.

The Baseline: What You’re Actually Paying Right Now

The most important number to keep in your head is 10%.

That’s the baseline reciprocal tariff that currently applies to most Chinese goods. It was part of the big deal reached on November 10, 2025. Before that, things were spiraling toward a 60% or even 100% flat rate. For now, the U.S. has agreed to keep the "heightened reciprocal tariffs" suspended until at least November 10, 2026.

But wait. It gets more expensive.

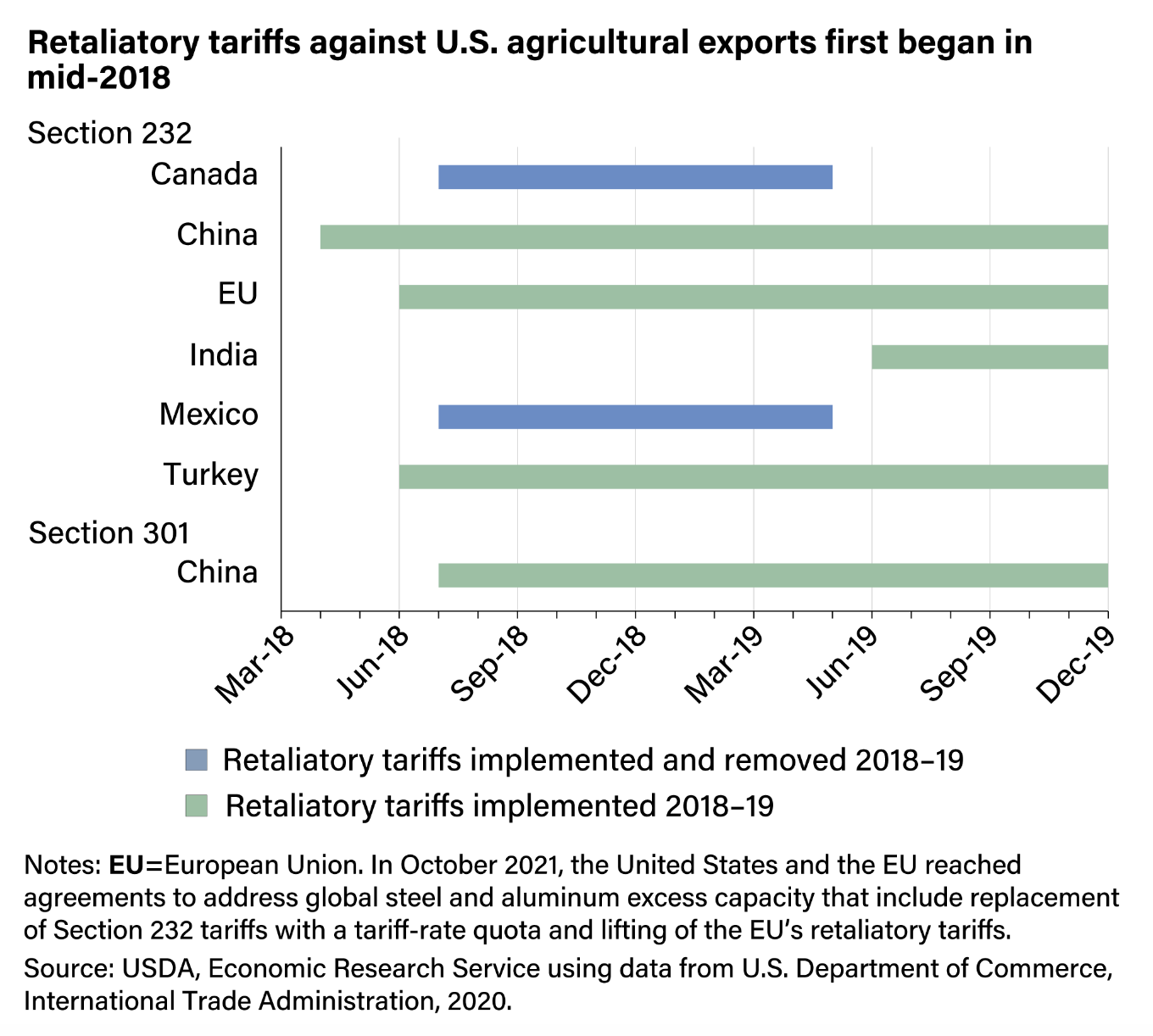

If you’re importing tech, you aren't just paying that 10%. You’re likely getting hit by Section 301 duties too. These are the "OG" trade war tariffs that have been around since 2018. While some were lowered during the recent truce, a lot of them stayed put at 25%. If you're moving semiconductors, that rate is even higher.

Basically, you’re looking at a stacked system. It’s like a "convenience fee" on top of a "service fee" on a concert ticket—except the ticket is a shipping container and the fee is thousands of dollars.

The Fentanyl Factor

One of the weirder twists in 2026 trade policy is the "Fentanyl Tariff." Last year, the administration slapped a specific 20% tariff on Chinese goods to pressure Beijing into cracking down on chemical precursors. As of the November deal, that was cut in half. So, there is currently a 10% cumulative rate specifically tied to this enforcement.

Semiconductors and the High-Tech Wall

If you are in the electronics or AI space, the news isn't great. Just a few days ago, on January 15, 2026, a new 25% Section 232 tariff kicked in for high-performance semiconductors.

✨ Don't miss: Today Gold Rate in Hyderabad 22 Carat: Why Prices Just Won't Settle

This isn't just a tax on the chips themselves. It covers:

- Logic integrated circuits.

- Advanced AI computing components.

- Articles containing these specific high-end chips (HTS 8471.50, 8471.80, and 8473.30).

The goal here is pretty obvious: make it so expensive to use Chinese silicon that companies are forced to buy from the new domestic fabs opening up in Arizona and Ohio. The U.S. Trade Representative (USTR) also just announced another layer of Section 301 tariffs on semiconductors. Right now, that rate is technically 0%, but it’s a "bargaining chip" (pun intended). They’ve scheduled a rate hike for June 23, 2027, but the President can dial that up or down whenever he feels like he needs more leverage.

The De Minimis Crackdown: No More Freebies

For years, companies like Shein and Temu lived in a loophole. If a package was worth less than $800, it came into the U.S. duty-free. That’s over.

Since August 2025, the "de minimis" exemption for Chinese goods has been effectively gutted. If you’re a consumer ordering a $20 shirt, you might not see the tariff on your receipt yet, but the companies are feeling it. All postal shipments from China and Hong Kong are now hit with a 54% duty rate.

Originally, there was talk of a $200 flat fee per item. Luckily for your wallet, that was canceled. But 54% is still a massive jump from the 0% we had two years ago.

Why the Average Tariff is 17% (and rising)

If you look at the big-picture data from the Tax Policy Center, the average tariff rate on all imports is now 17%.

💡 You might also like: Short SPY ETF 3x: Why This Trade Is Way Riskier Than You Think

That might sound low compared to the 50% or 100% headlines, but you have to remember that "average" includes everything from Canada and Mexico (which have some exemptions) to China. If you isolate just Chinese imports, the effective rate is much higher.

| Product Category | Current 2026 Tariff Status |

|---|---|

| Electric Vehicles (EVs) | 100% (virtually a total ban) |

| Semiconductors | 50% - 75% (combined rates) |

| Steel and Aluminum | 25% - 50% (depending on specific derivative) |

| General Consumer Goods | 10% (Baseline) + any applicable Sec 301 (often 10-25%) |

| Solar Panels | High double digits, though slightly reduced from 2025 peaks |

What Most People Get Wrong About These Tariffs

A lot of people think the "truce" means the trade war is over. It isn't. It’s just "managed" now.

The biggest misconception is that these tariffs are static. They aren't. President Trump has been using the International Emergency Economic Powers Act (IEEPA) to move rates around without waiting for Congress. This means a tweet on a Tuesday can change your business costs by Friday.

Another big mistake? Thinking you can just ship through Vietnam or Mexico to skip the tax. Customs and Border Protection (CBP) has gone into overdrive for 2026. They call it the "Year of Enforcement." They are looking at "melt and pour" requirements for steel and "smelt and cast" for aluminum. If the raw material started in China, they’re going to find it and tax it.

The 2026 Outlook: What Happens Next?

We are currently in a holding pattern. The U.S. and China are scheduled to meet several times this year—at least two or three "summits" are on the books.

China has already started playing ball by suspending their retaliatory tariffs on American soybeans, pork, and corn. They’ve even promised to buy 25 million metric tons of soybeans this year. In exchange, the U.S. is keeping the 10% baseline steady.

But this is a fragile peace.

If the fentanyl enforcement isn't high enough, or if the trade deficit doesn't shrink, those "suspended" rates of 60% are still sitting in a drawer in the Oval Office, ready to be signed.

Actionable Steps for 2026

- Check your HTS codes immediately. Specifically, look for the new Chapter 99 provisions (9903.79.01 through 9903.79.09) if you deal in tech.

- Audit your supply chain for "Country of Melt." You can't just rely on where the final product was assembled anymore.

- Watch the November 10, 2026 deadline. That’s when the current "truce" expires. If you have big shipments coming in late Q4, you might want to move them up to October to avoid a potential "cliff" where rates jump back up.

- Budget for the "Household Tax." Experts estimate that the current tariff structure will cost the average American household about $2,100 this year in higher prices.

The reality is that what's the current tariff on china is no longer just a business question—it’s a cost-of-living question. Whether you're buying a laptop or a load of industrial steel, you're paying the "geopolitical premium." Keep your eyes on the USTR notices; in 2026, the only constant is that the numbers will change.