You’re staring at your banking app, eyeing that "Request Increase" button. It’s tempting. Really tempting. Maybe you’ve got a big vacation coming up, or maybe you just want that sweet, sweet dopamine hit of seeing a five-figure limit on your dashboard. But timing is everything. If you click that button today and get rejected, you might have to wait another six months before the bank even considers looking at your file again. Honestly, most people treat a credit limit increase like a random lottery ticket, but the banks are actually following a very specific, very boring script.

If you want to know when to ask for credit line increase requests to actually stick, you have to look at your financial life through the eyes of an underwriter. They aren't your friends. They’re risk managers. They want to give you more money, but only if they’re 100% sure you don't actually need it. It’s the ultimate irony of the American financial system: the best time to ask for more credit is when you’re already flush with cash.

The Six-Month Rule and Why It Actually Matters

Don't even think about asking for an increase if you just opened the card. Seriously. Most major issuers like American Express, Chase, and Capital One have internal "cool-down" periods. For a brand-new account, that’s usually 180 days. Some people try their luck at the 90-day mark, and occasionally it works with Amex, but for the most part, you’re just wasting a hard inquiry for nothing.

Hard inquiries are those pesky little marks on your credit report that happen when a lender pulls your full file. According to FICO data, a single hard inquiry can shave five to ten points off your score. While that’s not a death sentence, if you’re asking for increases across four different cards in one week, you’re going to look desperate. Desperation is a massive red flag. Banks hate it. They want "boring" customers who pay their bills on time and barely use 10% of their limit.

Wait for the income jump

Did you just get a raise? That’s your golden ticket. When you update your income on the issuer’s portal, their internal algorithm often triggers a "pre-approved" flag. You don’t even have to beg. They see $85,000 instead of $65,000 and suddenly you’re a more attractive bet.

But keep it real. Don't inflate your numbers. While banks rarely ask for pay stubs for a simple $2,000 increase, if you’re shooting for a $50,000 limit, they might trigger a "financial review." That’s a nightmare. You’ll have to provide tax returns, and if you lied, they’ll close every account you have with them. It happened to a lot of people during the 2008 crash and again in 2020—banks get twitchy when the economy wobbles.

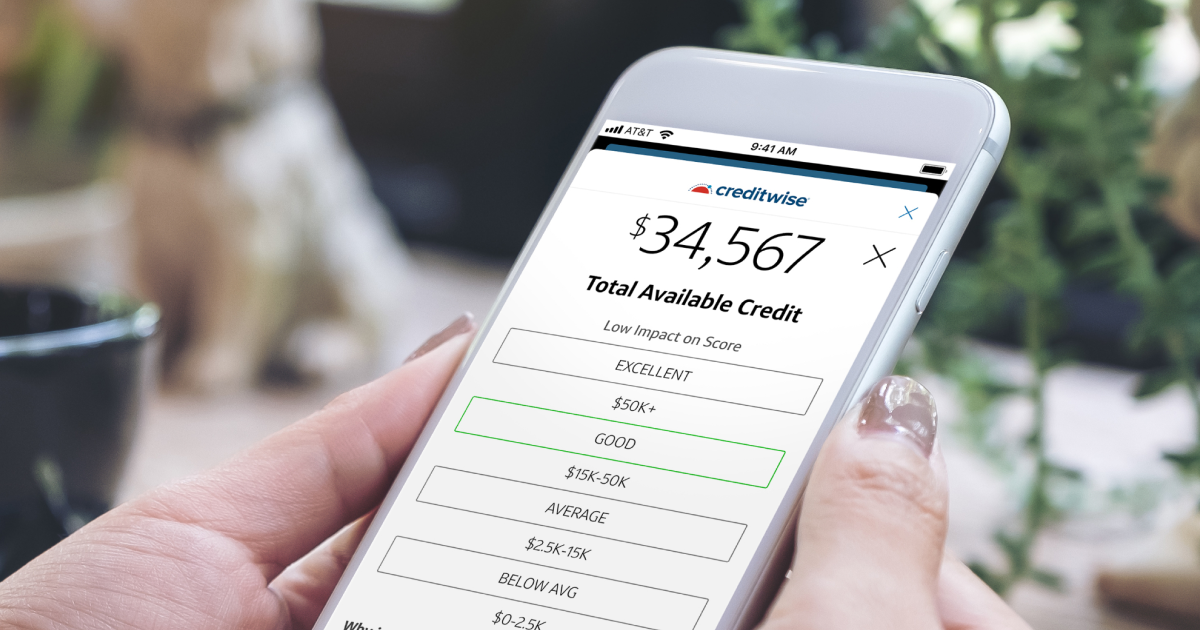

The Utilization Paradox

Here is the weird part. If you’re using 90% of your current limit, you might think, "I need an increase so my utilization goes down!" That makes sense to you. It does not make sense to the bank. To them, it looks like you’re overextended and might be about to default.

🔗 Read more: Is Flipping Homes Profitable? What the Pros Don’t Tell You on TV

The sweet spot for when to ask for credit line increase is when your utilization is between 1% and 10%. You want to show them that you use the card, but you don't need the card to survive. If you have a $5,000 limit, try to have a balance of about $200 when the statement closes, then pay it off, and then ask for the increase. This proves you’re responsible.

Does the "Hard Pull" Still Exist?

It depends on the bank.

- Chase: Usually does a hard pull. It’s annoying.

- American Express: Almost always a soft pull (no score damage).

- Capital One: Hit or miss, but usually soft.

- Citi: They usually tell you upfront if it will affect your score.

Always ask the representative: "Will this be a hard inquiry or a soft pull?" If they say they don't know, hang up. Or just use the app. Most apps will give you a disclosure before you hit submit. Read the fine print.

The Best Times to Strike

Timing isn't just about months; it's about the broader economy. When the Federal Reserve is hiking rates and the news is full of "recession" talk, banks tighten their belts. They get stingy. Conversely, when consumer spending is high and the economy is "frothy," they hand out increases like candy.

You should also look at your own credit score peaks. If you just paid off a car loan or a student loan, your score might have jumped. That’s a great window. Or maybe a negative mark—like an old late payment from five years ago—just fell off your report. That’s your moment. Your profile just became "cleaner" in the eyes of the automated systems that handle these requests.

The "Automatic" Increase Trap

Sometimes, banks just give you more money without you asking. This is great, right? Usually. But it can also be a sign they’re trying to tempt you into spending more so they can collect more interest. If you’re someone who struggles with overspending, a higher limit is just a bigger hole to fall into. Honestly, if you don't trust yourself, don't ask for the increase. The 30-point boost to your credit score isn't worth $10,000 in high-interest debt.

Strategies for a "Yes"

- The "Big Purchase" Tactic: Call them up. Tell the rep, "Hey, I’m planning on buying some new appliances/a engagement ring/a trip to Italy next month and I’d love to put it on this card for the points, but the current limit is a bit tight. Can we bump it up?" This gives them a logical reason for the request that isn't "I'm broke."

- The Competitor Pivot: "My other card with [Competitor Bank] just gave me a $15,000 limit, and I find myself using them more because of it. I’d prefer to keep using your card, though." Banks are competitive. They want to be your "top of wallet" card.

- The Annual Update: Every 12 months, go into your profile and update your "Total Annual Income." Even if it only went up by $2,000 because of a cost-of-living adjustment, tell them. The system loves fresh data.

When the answer is "No"

It happens. You get the "Letter of Adverse Action" in the mail ten days later. It’ll say something vague like "Serious delinquency" or "Insufficient time with current limit." Don't take it personally. It’s just an algorithm.

🔗 Read more: Barry Turner Lenny and Larry's: What Really Happened Behind the Cookie Empire

If you get denied, wait. Don't call back the next day. Use the card for small purchases, pay it off in full every month, and try again in exactly six months. During those six months, focus on lowering your overall debt-to-income ratio. That is the single biggest factor outside of your actual credit score.

Deep Nuance: The Debt-to-Income (DTI) Ratio

You could have an 800 credit score and still get denied a credit line increase. Why? Because you’re only making $30,000 a year and you already have $50,000 in available credit across five cards. Banks have a "total exposure" limit. They won't lend you more than a certain percentage of your annual income.

For example, Chase is known for being hesitant to extend total credit across all their cards that exceeds 50% of your reported income. If you make $100k and they’ve already given you $50k in limits, you’re likely tapped out with them unless you close one card to increase the limit on another. This is a nuance most "finance gurus" ignore.

How to calculate your "Safe" limit

Look at your gross monthly income. Subtract your rent/mortgage and your minimum debt payments. If what’s left over is less than a few hundred dollars, you’re in the "high risk" zone. Banks see that. They know that if one emergency happens—your transmission blows or your cat needs surgery—you’re going to max out that card and potentially stop paying.

Actionable Steps for Your Next Request

If you’ve decided that now is the right time, follow this specific sequence to maximize your chances.

- Clean up your report first. Check for any errors on AnnualCreditReport.com. If there's a "late payment" that shouldn't be there, dispute it before asking for more credit.

- Pay down your balance. Ensure your current card balance is below 5% of the limit. Wait for the statement to close so the bank sees that low balance on your credit report.

- Check for "pre-qualified" offers. Log into your account. Sometimes there’s a banner that says "You’re eligible for a higher limit." If you see that, the odds of a "No" are almost zero.

- Choose your method. If you’re nervous, use the app. It’s instant and painless. If you have a complicated situation (like being a freelancer with fluctuating income), call and talk to a human. Humans have "discretionary authority" that apps don't.

- Be specific with the number. Don't just say "more." If you have a $2,000 limit, ask for $5,000. Asking for a $20,000 limit on a $2,000 base usually triggers an automatic manual review, which is harder to pass. A 2x or 3x increase is the standard "safe" ask.

Ultimately, a credit limit increase is a tool. It lowers your utilization, which helps your score, and it gives you a safety net. But it’s only a win if you keep your spending habits exactly the same as they were before. If a higher limit feels like "free money," you aren't ready for it yet. Keep your head down, pay the bills, and wait for that moment when your income and your credit history align perfectly. That's when you hit the button.

Next Steps for Your Credit Strategy:

- Audit your current accounts: List out every card, its current limit, and the last time you received an increase.

- Mark your calendar: If it's been less than six months since your last increase or since you opened the account, set a reminder for the 181st day.

- Update your income: Log into your primary bank's portal today and ensure your reported annual income is current to the dollar.

- Check for "Soft Pull" status: Research your specific card issuer on forums like MyFico to see if they are currently doing hard or soft pulls for requests.