You’re driving down a Texas highway or maybe navigating a rainy street in Quebec, and you see that familiar teal and white logo. You pull in, swipe your card, and fill up. But if you think you’re buying gas from a "gas station company," you’re only seeing the tip of a very massive, very industrial iceberg.

Most people assume who owns Valero gas stations is a simple question with a one-word answer. It's not.

Valero Energy Corporation is a behemoth headquartered in San Antonio, but the story of who actually owns the station on your corner is a tangled web of corporate spinoffs, institutional investors, and independent franchisees. Honestly, if you walked into Valero headquarters today and asked to speak to the "owner" of the station down the street, they’d probably tell you they don't even own the building.

The Big Split: Why Valero Isn't Really a "Retailer" Anymore

Back in the day, Valero was like any other integrated oil company. They found the oil, they refined the oil, and they sold it to you at their own stores. But in 2013, everything changed.

The executives realized that running a refinery—where you’re dealing with massive chemical plants and global crude prices—is a completely different beast than running a convenience store where you're worried about the price of Milk Duds and fountain sodas. So, they cut the cord. Valero spun off its entire retail wing into a separate company called CST Brands (the people behind Corner Store).

Later, a giant Canadian company called Alimentation Couche-Tard—you probably know them better as Circle K—swallowed CST Brands whole.

So, here is the kicker: Valero Energy Corporation generally does not own or operate the gas stations that carry its name. Instead, they operate as a "wholesaler." They sell the fuel and the right to use their brand name to independent business owners or large retail chains. It’s a bit like how a McDonald's might be owned by a local guy in your town, but the burgers come from the corporate supply chain.

Who Pulls the Strings at Valero Energy Corporation?

Since Valero is a publicly traded company on the New York Stock Exchange (ticker: VLO), the "owner" is technically anyone with a brokerage account. But let’s be real. You and I owning ten shares doesn’t mean we’re calling the shots.

As of early 2026, the real power lies with institutional giants. We’re talking about the massive "passive" investors that manage trillions of dollars for retirement accounts and pensions.

- The Vanguard Group: Usually sitting at the top, holding roughly 12% of the company.

- BlackRock: Coming in strong with about 8.5%.

- State Street Corporation: Typically holding around 6%.

These three companies alone own a massive chunk of Valero. If you have a 401(k) or an IRA, there is a very high chance you are a tiny, partial owner of Valero without even knowing it.

The Face of the Company

While the "owners" are mostly faceless investment funds, the man running the show is Lane Riggs. He took over as CEO in 2023 and became Chairman of the Board at the end of 2024. Riggs is a Valero lifer—he’s been with the company since 1989. He’s a chemical engineer by trade, which tells you everything you need to know about what Valero cares about: the technical side of making fuel, not the retail side of selling snacks.

The Massive Scale Nobody Talks About

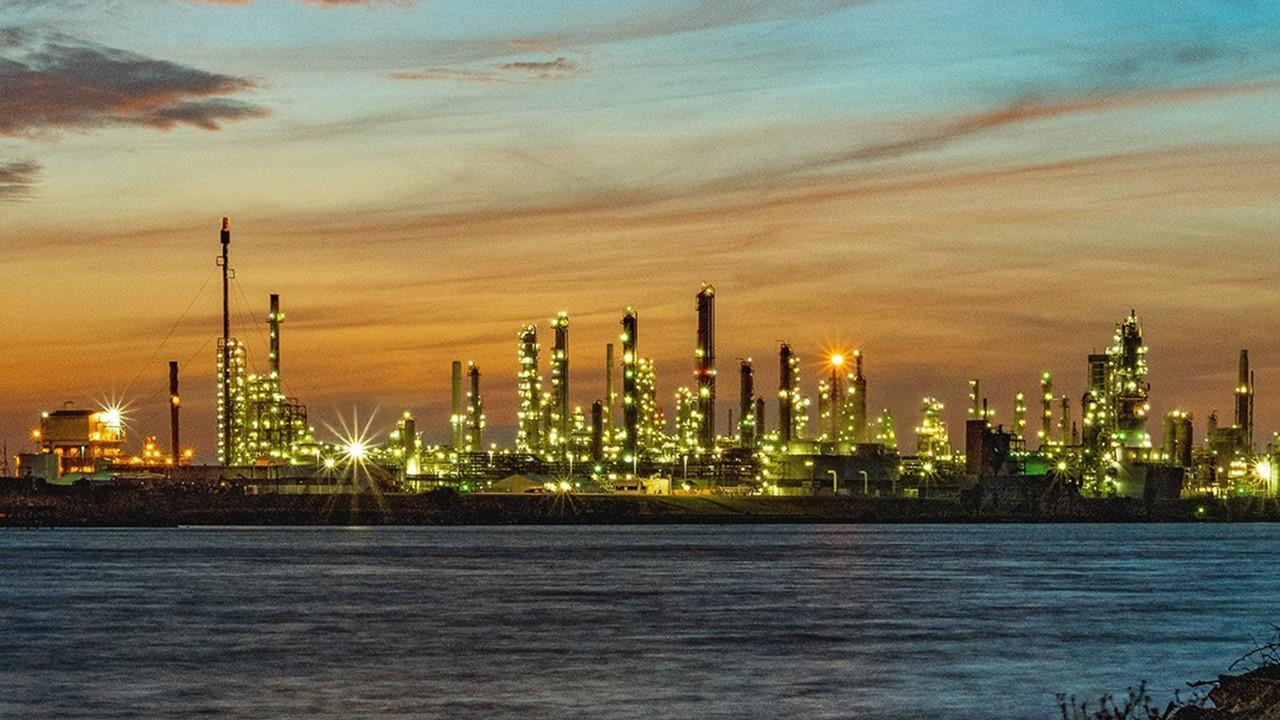

We see the gas stations, but Valero is actually one of the largest independent petroleum refiners in the world. They have 15 refineries scattered across the U.S., Canada, and the U.K. Their total throughput capacity is about 3.2 million barrels per day. That is a staggering amount of fuel.

But the 2026 landscape is changing. Valero is currently making headlines for shutting down or "idling" its refinery in Benicia, California. Why? Because the regulatory environment in California has become a nightmare for oil companies. It’s a huge deal for West Coast gas prices, and it shows that even though Valero is a giant, they aren't immune to politics or the "green" shift.

It’s Not Just Gasoline Anymore

If you think Valero is just about "old oil," you’re missing the newest part of their portfolio. They are now one of the world's largest producers of renewable diesel.

They have a massive joint venture called Diamond Green Diesel with Darling Ingredients. They take things like used cooking oil and animal fats and turn them into fuel. In 2024, they even completed a massive Sustainable Aviation Fuel (SAF) project in Texas. So, the next time you’re on a Southwest Airlines flight out of Chicago Midway, there’s a decent chance the plane is running on Valero-made "green" fuel.

Sorting Fact from Fiction: Who Owns Your Local Station?

If you see a Valero sign, you are likely looking at one of three things:

📖 Related: Estimated 2026 Tax Brackets: What Most People Get Wrong About the Post-TCJA Cliff

- A Circle K / Corner Store: These are owned by Alimentation Couche-Tard but have a contract to sell Valero fuel.

- A Multi-Station Distributor: A regional company that owns 50 stations and licenses the Valero brand.

- A "Mom and Pop" Franchise: A single owner who pays Valero for the right to use the sign and the credit card processing system.

This is why the coffee at one Valero might be great, while the one five miles away feels like it hasn't been cleaned since 1994. They are different businesses with different owners, just sharing a common fuel supplier.

Actionable Takeaways for the Curious Consumer

Understanding who owns Valero gas stations actually matters for your wallet and your community.

First off, if you have a complaint about a specific station—dirty bathrooms, bad service—don't call Valero corporate in San Antonio. They literally can't help you because they don't own the store. Look for the "Owned and Operated by" sticker usually found on the front door or the pump.

Secondly, keep an eye on those institutional owners like Vanguard and BlackRock. Because they are under pressure to meet "ESG" (Environmental, Social, and Governance) goals, they are the ones pushing Valero to invest in that renewable diesel and sustainable aviation fuel we talked about.

Finally, if you're an investor, remember that Valero is a "margin" business. They don't care as much if oil is $100 or $50 a barrel; they care about the difference between what they pay for crude and what they sell the gasoline for.

Valero is a refining giant that happens to have its name on a few thousand street corners. They make the fuel, they ship the fuel, but the guy behind the counter? He’s almost certainly not a Valero employee.

To get a true sense of the company's current health, you can track their quarterly earnings reports, which are usually released in late January, April, July, and October. These reports offer the most transparent look at their refining margins and their transition into the low-carbon fuel market.